|

Business Formation and Consultation

|

Real Estate and Business Contracts

|

Personal Injury

The handling of a motor vehicle (e.g. car) accident case requires knowledge of the California vehicle code and a comprehensive understanding of the various automobile insurance provisions now available in the State. Over the years we have had the experience of meeting every challenge to our case, including the dispute of liability, the comprehensive search for hidden insurance coverage and the unique situations presented when the responsible party may or may not have been insured in the car he was driving. We have had favorable outcomes against the driver of our client’s car when our client has been riding as a passenger in his or her own car. The experience of our staff is a key factor which helps in the analysis of each case even before it reaches the handling attorney. Our key staff members have over twenty years experience in handling many facets of the case including, repair to vehicle, negotiation of towing and storage fees, and interpretation of injuries so that the proper health care professional may be readily identified without delay. In all the cases we handle there is a complimentary payment by us of certain costs and fees, including police and highway patrol reports, medical records charges, hospital records retrievals, defendant searches and Department of Motor Vehicles report charges. For more information please feel free to contact us about your case.

The streets in our environment have become much more dangerous as a result of many factors, including automobile drivers' use of cell phones and texting while driving and as a result we have seen more of these incidents where a driver strikes a pedestrian lawfully walking in a marked crosswalk. Other complications such as permissible right turns at a red light can result in a pedestrian injury. We have had cases where a driver with a flat tire exits his vehicle and begins to replace his flat tire when he has been struck while standing by or behind his car. Finally, there are pedestrians who are struck when they are crossing the street when not in a marked crosswalk. In any of these circumstances we have successfully obtained fair compensation for our clients who have suffered serious injury or death as a result of a vehicle striking pedestrian.

"Slip and fall" or sometimes referred to as "trip and fall" incidents arise very frequently as a result of a variety of reasons including such as owner negligently maintaining his property (1) by allowing a sprinkler system to flood a coating of mud onto the walkway, or (2) by a mall or store owner failing to maintain the flooring in a clean and safe condition, or (3) by failing to provide adequate lighting to allow customers to see obstructions in a parking lot and many more situations. If you suffer an injury while walking indoors and outdoors in the day or night or on a rainy day, you may have an injury for which someone is responsible because of negligent acts. In the three examples mentioned above we have successfully obtained fair compensation for our clients who have suffered serious injury as a result of negligent acts which created an unreasonable risk of harm.

Sometimes the damage to a vehicle and the injury to the client exceed what the expectation may be based upon the fact and circumstances of the collision. In our experience we have been in these cases. In a notable case we handled an auto manufacturer continued to use a faulty gas tank assembly design it had copied from a competitor’s product even after the competitor had corrected the fault in the assembly design. In our case, there was a rear end impact followed by an explosion and fire generated by the leaking gasoline. One of the occupants of the car was killed and the other suffered significant burns. Once the manufacturer was able to see the preparation of the case by our side the case settled very favorably for our client shortly before trial. This case exemplified why it is so important to recognize the possibility of defective designs or manufacture and not just settle a case against another driver for his insurance coverage.

In other defective product cases, the manufacturer, distributor, and seller of a consumer product all have a legal duty to produce and sell products that are free of unreasonable or unexpected dangers to consumers. For more information please feel free to contact us about your case.

In other defective product cases, the manufacturer, distributor, and seller of a consumer product all have a legal duty to produce and sell products that are free of unreasonable or unexpected dangers to consumers. For more information please feel free to contact us about your case.

For the most part, we in Southern California are fortunate to have well trained and caring physicians in our environment. Nonetheless, malpractice still happens in a small minority of medical procedures. If you are the victim of this type of negligence, California State law provides that the injured patient may recover up to $250,000 for his or her general damages plus compensation for actual special damages for such continuing medical care which may be required as a result of the malpractice and other losses such as earnings. To process this type of case the patient would need to have at least one medical professional (an expert in the medical procedure undertaken) prepared to testify as to the malpractice and the fees for this expert and all of the other costs of handling the case are generally advanced by the law firm.

Dog bites are responsible for a great many injuries each week in California as well as the rest of the country. The statistics show that many of the aggressive dogs are the larger breeds which can cause severe injuries when they bite. If you have been a victim of a dog bite which occurs in the home of the owner of the dog, in our experience we have never lost this type of claim. Sometimes a client may be bitten by a dog on the street which on occasion may present potential defenses to the claim such as the aggravating behavior of the victim. These cases can sometimes become more challenging. Generally, the dog owner will be defended first by his insurance company if the claimant does not have an attorney and then by an attorney hired by his or her homeowner’s insurance if a law suit is filed. Part of the defense strategy in these cases is to delay the claimant from filing a lawsuit so that the claim becomes barred by the statutory time limit to file a lawsuit. In any event, they will work hard to reduce your claim and the attorney fighting for you must be prepared to move the case forward to trial. For more information please feel free to contact us about your case.

A wrongful death claim is applicable when a victim who would otherwise have a personal injury claim is killed as a result of either negligence or an intentional harmful act on the part of the defendant. This can occur in a variety of situations, including: when a victim is intentionally killed, when a victim dies as a result of medical malpractice, and car accident fatalities involving negligence. Wrongful death claims allow the estate of the deceased person to file a lawsuit against the party who is legally liable for the death. The suit is usually filed by a representative of the estate on behalf of surviving family members.

Business Formation and Consultation

One of the main reasons for an individual to establish a corporation is to separate and shield his personal assets from the risks associated with the ownership of a business. By establishing a corporation the owner’s assets would not be at risk for such liabilities arising from contractual liability, uninsured injuries suffered at the workplace by customers or employees, violations of the labor code or Americans with Disabilities Act, Fair Employment and Housing Act, Unruh Act, trademark or patent violation and many more risks all of which have arisen for clients of our firm.

A corporation may establish a pension plan into which the owner(s) can deposit greater amounts than allowable as an individual, which is a great advantage.

A corporation may establish a medical reimbursement plan to deduct from taxable income one hundred percent of all amounts paid for health insurance, doctor and hospital or pharmaceutical bills, whereas these expenses may all be lost on a high earner’s individual tax return.

Upon formation of a corporation the owner(s) have a choice and elect either to be treated as a C corporation, which files and is subject to income tax, as reported on Internal Revenue Service form 1120; or the election to be treated as an S corporation, which files an informational tax return with the Internal Revenue Service on form 1120S. If the S corporation is elected, the net income or loss from business operations reported on the form 1120S is reflected on federal form K-1 and the owner(s) include this amount on their individual income tax return.

S corporations may only be elected by legal residents.

A corporation may establish a pension plan into which the owner(s) can deposit greater amounts than allowable as an individual, which is a great advantage.

A corporation may establish a medical reimbursement plan to deduct from taxable income one hundred percent of all amounts paid for health insurance, doctor and hospital or pharmaceutical bills, whereas these expenses may all be lost on a high earner’s individual tax return.

Upon formation of a corporation the owner(s) have a choice and elect either to be treated as a C corporation, which files and is subject to income tax, as reported on Internal Revenue Service form 1120; or the election to be treated as an S corporation, which files an informational tax return with the Internal Revenue Service on form 1120S. If the S corporation is elected, the net income or loss from business operations reported on the form 1120S is reflected on federal form K-1 and the owner(s) include this amount on their individual income tax return.

S corporations may only be elected by legal residents.

This form of entity is the most flexible type of corporation. It allows for the greatest number of member owners and also allows the owner(s) the choice of reporting its results of business operations on either a partnership or corporation income tax return. If there is a single owner, he or she may report net income or loss directly on his or her individual income tax return.

It is not necessary to be a citizen or resident of the U.S. to become a member of an LLC.

It is important for the LLC to create an operating agreement to provide for important operational details such as the management of the company, where it will be located and what are its purpose of and business focus.

It is not necessary to be a citizen or resident of the U.S. to become a member of an LLC.

It is important for the LLC to create an operating agreement to provide for important operational details such as the management of the company, where it will be located and what are its purpose of and business focus.

For business ventures of two or more people, the formation of a partnership is a simple and minimal method to provide for the terms of the agreement between the owners. By creating the partnership contract the owners of the business memorialize in writing such important issues as each partner’s capital contribution to the business, division of profits and losses and also the agreement provides answers for such questions as each partner’s responsibilities to the business.

When partners establish a business but fail to execute a partnership agreement it is possible that the terms of their agreement may be forgotten or disputed with the passage of time. Litigation between partners may likely result in unfair decisions in court when the basic details of the business are disputed and neither partner is able to prove his capital contribution to establish the business. Partners in this position will find that when they litigate their disputes in a court the judge will not help them create their unwritten agreement and it is likely that all parties will leave the courtroom disappointed.

When partners establish a business but fail to execute a partnership agreement it is possible that the terms of their agreement may be forgotten or disputed with the passage of time. Litigation between partners may likely result in unfair decisions in court when the basic details of the business are disputed and neither partner is able to prove his capital contribution to establish the business. Partners in this position will find that when they litigate their disputes in a court the judge will not help them create their unwritten agreement and it is likely that all parties will leave the courtroom disappointed.

If you will be completing services for a person or company on a project-to-project basis or you will be receiving services from an independent contractor or consultant, you may need an Independent Contractor Agreement to ensure both parties are protected.

Real Estate and Business Contracts

A purchase and sale agreement is a legal contract that obligates a buyer to buy and a seller to sell a product or service. If you are a buyer or a seller in any kind of business, a purchase and sale agreement is a way of finalizing the interests of both parties before closing the deal.

With the increasing globalization of markets, international contracts are becoming a common practice for many companies. Drafting an international contract can be a difficult and mysterious subject for companies, but a good international sales agreement is necessary to facilitate a mutually beneficial contractual relationship between your entity and the other party or parties.

Estate Protection

A revocable living trust will help you manage your assets or protect those assets should you become ill, disabled or simply challenged by the symptoms of aging. Most living trusts are written to permit you to revoke or amend them whenever you wish to do so. The revocable trusts do not help you avoid estate tax because your power to revoke or amend them causes those assets to remain in and be included in your estate. These trusts do help you avoid probate, which may not always be necessary depending on the cost and complexity of probate in your estate. Attorney fees and court costs in California to probate an estate of $500,000 would be in excess of $20,000.00, but the living trust avoids this expense .

The living trust is legally in existence during your lifetime, has a trustee who currently serves, and owns property which (generally) you have transferred to it during your lifetime. While you are living, the trustee (who may be you, although a co-trustee might also be named along with you) is generally responsible for managing the property as you direct for your benefit. Upon your death, the trustee is generally directed to either distribute the trust property to your beneficiaries, or to continue to hold the assets and manage them for the benefit of your beneficiaries. Like a will, a living trust can provide for the distribution of property upon your death. Unlike a will, it can also (a) provide you with a vehicle for managing your property during your lifetime, and (b) authorize the trustee to manage the property and use it for your benefit (and your family) if you should become incapacitated, thereby avoiding the appointment of a guardian for that purpose.

We can also help you create an "irrevocable" living trust; this type of trust may not be revoked or changed, and such a trust is almost exclusively done to produce certain tax or asset protection results. Schedule a consultation to learn more.

The living trust is legally in existence during your lifetime, has a trustee who currently serves, and owns property which (generally) you have transferred to it during your lifetime. While you are living, the trustee (who may be you, although a co-trustee might also be named along with you) is generally responsible for managing the property as you direct for your benefit. Upon your death, the trustee is generally directed to either distribute the trust property to your beneficiaries, or to continue to hold the assets and manage them for the benefit of your beneficiaries. Like a will, a living trust can provide for the distribution of property upon your death. Unlike a will, it can also (a) provide you with a vehicle for managing your property during your lifetime, and (b) authorize the trustee to manage the property and use it for your benefit (and your family) if you should become incapacitated, thereby avoiding the appointment of a guardian for that purpose.

We can also help you create an "irrevocable" living trust; this type of trust may not be revoked or changed, and such a trust is almost exclusively done to produce certain tax or asset protection results. Schedule a consultation to learn more.

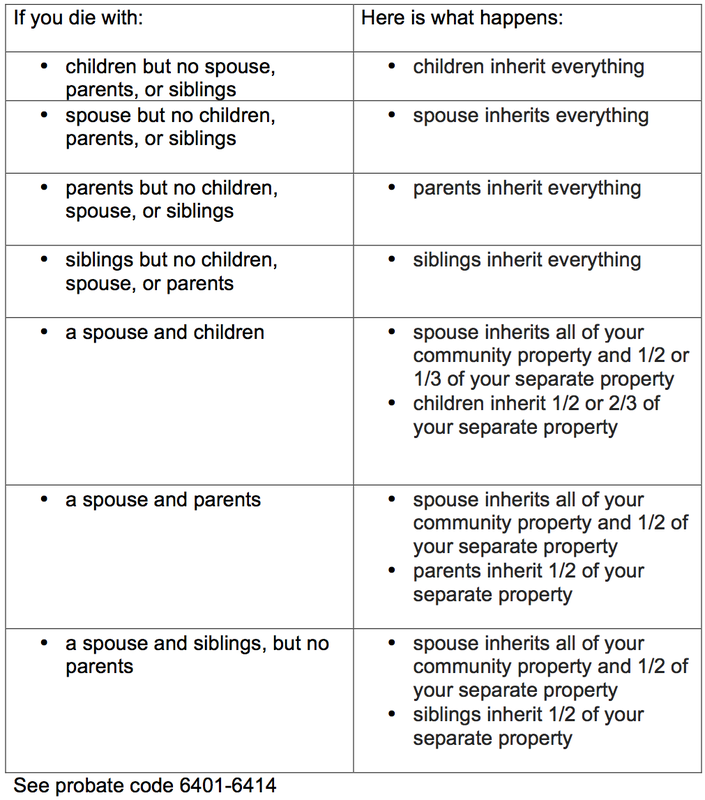

WillA properly drafted and executed Will serves as a document which may be filed with the Court and have its terms fulfilled and enforced by the Judge in the probate division. The Will provides an opportunity to direct your remaining assets at death to those beneficiaries you elect in the percentages or amounts of your choosing. The probate estate will be subject to attorneys fees and court costs to process which is why it is beneficial to place as much of your estate as possible into a living trust. Another reason to place assets into a living trust is that your beneficiaries may be able to access assets immediately without first obtaining a court order which could take months. Finally, for those people who pass away without leaving a Will, their assets will be distributed as provided in the Probate Code and that process may place assets to beneficiaries in a manner which is contrary to what is desired (See the adjoining chart).

|

If a single adult does not have a Durable Power of Attorney and becomes mentally incapacitated, a guardianship must be filed in Superior Court for his/her benefit. This would be a time consuming and expensive process under which it is likely that the court would appoint an independent attorney to represent the incapacitated person and there would be little control over the attorney fees in this process.

A Physician’s Directive is your written expression of how you want to be treated in certain medical circumstances. Depending on state law, this document may permit you to express whether you wish to be given life-sustaining treatments in the event you are terminally ill or injured, to decide in advance whether you wish to be provided food and water via intravenous devices ("tube feeding"), and to give other medical directions that impact your care, including the end of life. "Life-sustaining treatment" means the use of available medical machinery and techniques, such as heart-lung machines, ventilators, and other medical equipment and techniques that may sustain and possibly extend your life, but which may not by themselves cure your condition. Be very careful signing any such document without reviewing the implications to you. For example, some of the commonly used clauses in Physician’s Directives may forbid the provision of assisted breathing, including devices you presently may be using if, for example, you are living with Chronic Obstructive Pulmonary Disease ("COPD"). Most important, many of the provisions of such a document have profound religious and philosophical implications. Be certain that whatever you sign is consistent with your beliefs and wishes. In addition to terminal illness or injury situations, most states also permit you to express your preferences as to treatment using life-sustaining equipment or tube feeding for medical conditions that leave you permanently unconscious and without detectable brain activity.

A Physician’s Directive applies in situations in which the decision to use such treatments may prolong your life for a limited period of time and not obtaining such treatment would result in your death. Having a Physician’s Directive does not mean that medical professionals would deny you pain medications and other treatments that would relieve pain or otherwise make you more comfortable. Physician’s Directives do not determine your medical treatment in situations that do not affect your continued life, such as routine medical treatment and non life-threatening medical conditions. Most states permit you to include other medical directions that you wish your physicians to be aware of regarding the types of treatment you do or do not wish to receive. In all states the determination as to whether you are in such a medical condition is determined by medical professionals, usually your attending physician and at least one other medical doctor who has examined you or reviewed your medical situation.

A Physician’s Directive applies in situations in which the decision to use such treatments may prolong your life for a limited period of time and not obtaining such treatment would result in your death. Having a Physician’s Directive does not mean that medical professionals would deny you pain medications and other treatments that would relieve pain or otherwise make you more comfortable. Physician’s Directives do not determine your medical treatment in situations that do not affect your continued life, such as routine medical treatment and non life-threatening medical conditions. Most states permit you to include other medical directions that you wish your physicians to be aware of regarding the types of treatment you do or do not wish to receive. In all states the determination as to whether you are in such a medical condition is determined by medical professionals, usually your attending physician and at least one other medical doctor who has examined you or reviewed your medical situation.

A prenuptial agreement might be the last thing on your mind if you are planning to get married, but it can provide you and your new spouse with clarity regarding what will happen with your property and finances if the two of you decide to divorce in the future.

A Family Limited Partnership can reduce the difficulties that a family can face when making decisions on how to handle money, property, and other family investments. A properly established Family Limited Partnership can be very profitable and save families thousands of dollars in gift and estate taxes and probate fees and costs while providing protection from creditors. It also provides flexibility not found in living trusts. When we establish a Family Limited Partnership, generally, the parents' estate may be transferred to their children over the course of many years in a tax free transfer consistent with gift tax regulations. We effectuate this transfer in such a manner so as to enable the parents to continue to control the assets which are transferred as well as receive as much, or all, of the income as is needed by the parents to maintain their lifestyle. Probate fees and attorneys costs can be very expensive and the typical probate estate may take at least six months to close, both of these at an extreme detriment to those who are to inherit the estate.

Immigration

Most immigrant visa applicants are for sponsership of spouse or family members such as parent, brother, or sister. Some of the other common visa applicants are for E5, EB5, and L-1A discussed below.

E5 Visa

This immigrant visa application is for employment creation investors. To qualify, an alien generally must invest between $500,000 and $1,000,000, depending on the employment rate in the geographical area, in a commercial enterprise in the United States which creates at least 10 new full time jobs for United States citizens or permanent residence aliens and other lawful immigrants (not including the investor's family). This visa is not yet available to Vietnam.

EB-5 Immigrant Investor

The U.S. government establishes regional zones within the united states. These zones are created to create growth and jobs. These zones may consist of smaller inner city areas or larger areas in underdeveloped rural areas outside the city. The goal of the regional zone is to create jobs for american citizens. For each $500,000 invested there must be 10 permanent jobs created. The permanent jobs are measured by use of a complicated formula and are analyzed by economists in the private sector and also approved by the government. Once the regional zone is established, developers may identify property within the zone for development of qualifying projects.

The developer engages a regional center group to prepare all the necessary documents to file with the U.S. government to obtain federal approval of the developer’s project and then prepare all of the contracts between the developer and the investors. The regional center group charges administrative fees of $35,000, per investor, on average for their services and this sum is paid by the investor.

The investor hires his own attorney to review all of the documentation of the project, including the U.S. government approval of the project, the contracts between the developer and the investors and the terms of the escrow. The attorney prepares all documents required by the I.N.S. in order to process the visa application. The attorney's fee is $35,000 plus additional I.N.S. fees, and this sum is paid by the investor.

The investor must prove that he has funds in Vietnam (or another country) which have been obtained legally and that these funds will be wired to the U.S. for the project. Funds are wired to a nationally recognized bank which will act as an escrow agent for the project.

The investor will make a deposit to the escrow once he signs the contract with the developer and will begin the visa application process including a payment of fees to the I.N.S..

Once the project is fully funded for the full amount required to complete the project, the escrow is ready to close. If the investor’s visa application has been approved, he and his family will receive a temporary two year visa immediately upon close of escrow. If the investor’s visa application has not been approved he will be refunded his $500,000, most of his administrative fees, and some of his attorney fees, but will lose his I.N.S. fees.

Funds in escrow will be released to the developer as the project is built. The developer will not get paid any funds in advance of work being done.

Generally, all the investor's money is treated as a loan to the developer and will earn a small interest rate for the term it is outstanding. Interest rates may vary by project. Most projects return all of the investor funds in 3 years with a 5 year maximum end of term due date. At completion of the project, the I.N.S. will issue a permanent green card to the investor and his family .

The developer engages a regional center group to prepare all the necessary documents to file with the U.S. government to obtain federal approval of the developer’s project and then prepare all of the contracts between the developer and the investors. The regional center group charges administrative fees of $35,000, per investor, on average for their services and this sum is paid by the investor.

The investor hires his own attorney to review all of the documentation of the project, including the U.S. government approval of the project, the contracts between the developer and the investors and the terms of the escrow. The attorney prepares all documents required by the I.N.S. in order to process the visa application. The attorney's fee is $35,000 plus additional I.N.S. fees, and this sum is paid by the investor.

The investor must prove that he has funds in Vietnam (or another country) which have been obtained legally and that these funds will be wired to the U.S. for the project. Funds are wired to a nationally recognized bank which will act as an escrow agent for the project.

The investor will make a deposit to the escrow once he signs the contract with the developer and will begin the visa application process including a payment of fees to the I.N.S..

Once the project is fully funded for the full amount required to complete the project, the escrow is ready to close. If the investor’s visa application has been approved, he and his family will receive a temporary two year visa immediately upon close of escrow. If the investor’s visa application has not been approved he will be refunded his $500,000, most of his administrative fees, and some of his attorney fees, but will lose his I.N.S. fees.

Funds in escrow will be released to the developer as the project is built. The developer will not get paid any funds in advance of work being done.

Generally, all the investor's money is treated as a loan to the developer and will earn a small interest rate for the term it is outstanding. Interest rates may vary by project. Most projects return all of the investor funds in 3 years with a 5 year maximum end of term due date. At completion of the project, the I.N.S. will issue a permanent green card to the investor and his family .

L-1A Intracompany Transferee Executive or Manager

The L-1A nonimmigrant classification enables a U.S. employer to transfer an executive or manger from one of its affiliated foreign offices to one of its offices in the United States. This classification also enables a foreign company which does not yet have an affiliated U.S. office to send an executive or manager to the United States with the purpose of establishing one.

General Qualifications of the Employer and Employee

General Qualifications of the Employer and Employee

- Have a qualifying relationship with a foreign company

- Currently be, or will be, doing business as an employer in the United States and in at least one other country directly or through a qualifying organization

- Generally have been working for a qualifying organization abroad for one continuous year within the three years immediately preceding his or her admission to the United States

- Be seeking to enter the United States to provide service in an executive or managerial capacity for a branch of the same employer or one of its qualifying organizations.